Nordstrom Inc. has launched a digital marketplace platform with the aim of increasing offerings on its website and app, increasing revenue and offering sellers a broader audience.

Digital growth is a top priority at Nordstrom. Last year, digital accounted for 36 percent, or about $5 billion, of Nordstrom’s total sales of $14.22 billion.

More from WWD

For now, Nordstrom is relaxing its new market format by not rushing to bring in a host of new brands right away. However, executives said they expect their online product range to grow by two to three times in the coming years, while keeping their online channels clean, customer-focused and service-oriented. The marketplace went live on Monday.

Key brands on the market that are new to Nordstrom include Dippin’ Daisy’s, a fast-growing swimwear brand; Luxury leather goods from Maison de Saber and Tracksmith, the running brand.

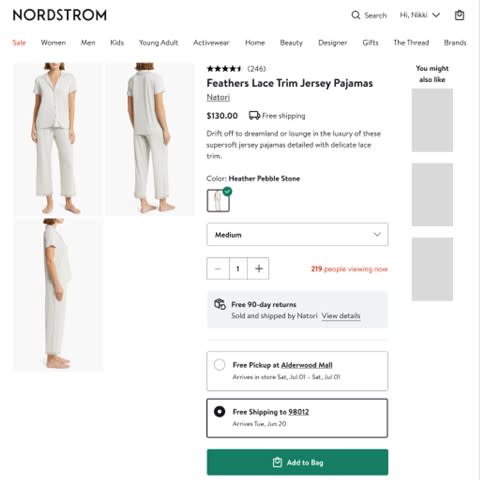

Other brands joining Nordstrom through the marketplace include AdoreMe, Alala, Ana Luisa, Cynthia Rowley, Derek Lam 10 Crosby, Deux Par Deux, Dia & Co., DXL, La DoubleJ, Natori and Onia.

“The sellers and brands on our marketplace will have the exact same threshold of quality and relevance to our customers as any other brand we do business with. A very high bar is set for the products we present to our customers. Nothing changes. We are not going to become ‘the everything store,’” Miguel Almeida, president of Nordstrom digital and customer experience, told WWD in an interview.

Reinforcing categories

“It’s about expanding our ability to find great brands that we think our customers will love, and introducing them to those brands on a larger scale, without the expense of a wholesale model,” Almeida added to. “The marketplace allows us to offer the full expression of the top brands we already have.”

When asked what categories not currently sold by Nordstrom could or will be introduced to the online marketplace, Almeida responded, “It’s not necessarily a category expansion strategy. It’s more about strengthening the categories we have and better serving customers in those categories.” However, he did select opportunities in the market to focus on the gifting categories, home and outdoor; accelerate growth with brands that target younger customers, offering larger sizes and a wider price range.

“Our marketplace will feel very connected to what Nordstrom is known for. It just gives us more flexibility and agility,” Almeida said. “We can also be much more targeted in better serving customers in different locations.”

Nordstrom is not aggressively seeking brands to introduce to its new digital marketplace. As Almeida said: “We want to make sure everything goes well before we scale and expand too quickly. It is fully live, but the market will not experience all that significant growth on day one, to ensure everything is fully in order as we present this new offering to customers.”

Nordstrom has partnered with Mirakl and its platform to allow brands to set up their assortments on retailers’ websites. “We see Mirakl as the leading solution in the industry and they have given us the opportunity to ultimately innovate with them in this area,” said Almeida.

He emphasized that Seattle-based Nordstrom will maintain its reputation for service through its marketplace. “We will handle customer service directly with the customer, which most other retailers’ marketplace models do not do,” Almeida said. “If there is a customer service issue, they put the customer directly in touch with the seller, bypassing their own customer service team. But we do our own care with customers, and then we deal with the brands separately. The customer will continue to keep in touch with us and the people he knows here. We honor our legacy of service and trust and say, ‘If you have any questions, let us know.’”

A customer who wants to return an item purchased on the marketplace can take it back to a Nordstrom store and receive the refund faster instead of sending it back to the seller and waiting days for the refund. “We will refund the customer directly and take the product just like any other product we offer through wholesale,” Almeida said.

From marketplace to brick and mortar

“There is also a very intentional connection between the marketplace and our stores,” he added. “Our stylists have access to style boards and can supplement their styling advice with a wider range than what they have in stores. We can also make changes to products purchased on Marktplaats. There is a service integration.”

The marketplace allows Nordstrom to respond more quickly to emerging trends. “It’s a much simpler process for brands to start selling with us,” says Almeida, compared to the traditional wholesale model. With the marketplace model, it can take less than 30 days from identifying a trend to placing the relevant items on the market. place.

Some marketplace items may also be sold in Nordstrom stores. “The idea is to be agile by showing customers relevant products and brands that we think they will love,” Almeida said. “Once we see that traction, our merchandising teams are informed about what they would like to buy and put in stores. Absolutely, this is a way for some brands to appear in our stores.”

With the marketplace model, brands control the content, pricing and shipping of merchandise, while Nordstrom can influence the look and feel of how products are presented. Nordstrom receives a commission when a listed item sells on the marketplace. Commissions are generally standard, with minimal variation or none at all, from brand to brand, Almeida said.

With the wholesale model, “We don’t have unlimited dollars. Our sellers have to make very difficult choices about the breadth and depth of the brands we sell to make the economics of our business work. Thanks to Marketplace, we can break free from these economic problems,” explains Almeida, who, together with his team, is responsible for Nordstrom.com, Nordstromrack.com and the customer experience strategy, both online and in stores. Before joining Nordstrom, he led Starbucks’ digital team and the design, product management and technology of the Starbucks mobile app. Previously, he was Executive Vice President of Digital at Lululemon Athletica and held leadership positions at Walgreens Boots Alliance, Apple, Dell and the Boston Consulting Group.

With the marketplace format, retailers do not own the goods and do not manage the shipping to customers, which is different from wholesale, where retailers own the goods purchased by their merchants, store them in their warehouses and stores and deliver them to customers deliver. It also differs from dropshipping where a retailer owns the goods sold online, but these are shipped by the supplier.

Risks and reputation

Retailers make less money on each item purchased on a marketplace because products are listed, not owned, and sold on commission. There is less financial risk and retailers may be able to make up for the loss of margin by generating higher volume with the wider range on the market. However, there are also other types of risks. Brands are sometimes located near other brands of inferior quality, which affects perception. Brands also run the risk of cannibalizing their sales in one marketplace from another. Additionally, if a consumer orders from a marketplace and is disappointed by a poor shipping experience (it arrives late or the wrong product is delivered), the marketplace may be blamed and its reputation may suffer, even though this may be the fault of the way the brand handles shipping.

Major digital marketplaces such as Amazon, eBay, Walmart, Alibaba, Farfetch and Shopify offer a wide range of categories and items. Some are characterized as “generalists,” meaning they offer everything to everyone without having a sharp identity or image – something Nordstrom promises to avoid. In recent years, a rapidly growing subset of smaller retail markets have emerged, including Macy’s, Bloomingdale’s, Hudson’s Bay, Best Buy, Stadium Goods, Lands’ End, Crate & Barrel and Urban Outfitters.

“Our vision is to become the Spotify of fashion, and that means taking signals from customers about what they want from us and showing them our growing extensive range in a way that is unique to them,” said Almeida. “We are making significant efforts to improve the experience of our website and mobile app. We will provide (both) with more inspiring content. We are going to make that discovery experience a lot more exciting with a much broader range that comes to life through the market.”

When asked if a marketplace could also be developed for the Nordstrom Rack off-price division, Almeida said: “We are not launching with Rack, but it could apply to Rack in the future.”

In addition to digital growth, Rack expansion is a priority for Nordstrom Inc. Rack has 22 new stores planned for this year, in addition to the 19 opened in 2023. On April 18, Nordstrom Inc. confirmed that brothers Erik and Pete Nordstrom want to take the retailer private and that a special committee of the board of directors was created. formed to evaluate their proposal and any other proposals. It’s a sign that the Nordstroms prefer to run their business for long-term success, rather than the short-term profits Wall Street demands. The new marketplace is a long-term project.

The best of WWD