Specialist meats such as Parma ham and Spanish chorizo sausage could disappear from UK supermarket and delicatessen shelves due to expensive new Brexit controls, food sector leaders say. The independent.

Rishi Sunak’s government has been warned of major supply problems with EU meat and dairy products as extra red tape and inspections are imposed on imports from April.

Some suppliers of specialist products – such as French cheeses, Italian hams and Spanish chorizo sausage – will abandon Britain because of the extra costs and “huge hassle” associated with shipping goods, industry bosses say.

Food sector leaders are also warning of supply issues with fruit and vegetables – including price spikes and potential shortages – when further controls on fresh produce come into force later this year.

It comes after alarm was raised over damage to plant and flower imports – as farming chiefs say new controls pose an “existential threat” to Britain’s horticultural businesses.

Mr Sunak has been urged for a new deal with Brussels on food and farming standards to avoid a “major step backwards” in UK supply chains.

From January 31, expensive new health certificates will be required for the import of medium-risk food, animals and plants, including meat and dairy. And on April 30, a brand new system for physical checks on these goods at the UK border will come into effect.

The Cold Chain Federation – which represents British companies importing chilled and frozen food – says it will cost EU suppliers hundreds of euros to have their products inspected by veterinary specialists before sending them across the Channel.

“If you are a small exporter – a supplier of meat such as Parma ham, salami or chorizo – the additional cost per shipment is likely to be hundreds of pounds,” says Tom Southall, the group’s executive director.

“There is a risk that some EU companies may decide not to get involved [with the UK] because they just don’t want to pay the extra costs,” he added. “So the British consumer may not have much choice in the future.”

The British Meat Processors Association (BMPA) also warns that the variety of specialty goods on shelves in Britain could dry up after physical checks begin in April.

Delis, food markets and restaurants will struggle to stock the same variety of artisanal goods, the BMPA has warned, as British importers dry up trading links with smaller European suppliers.

“The big fear is that smaller EU companies will find it all too messy and too expensive,” says Peter Hardwick, trade policy adviser at the BMPA. “It’s very, very concerning.”

The industry chief also warned of rising prices for key meat products – including Irish beef, French lamb and bacon and ham imported from Denmark, Germany and the Netherlands – due to the 2024 Brexit administration wave.

Mr Hardwick added: “This is the impact of Brexit. The new controls are a major step backwards in the way supply chains between close neighbors should operate.”

From next week, EU companies will have to pay for veterinary health certification – a new check in their own country – and fill out online paperwork to let Britain know of the good things to come.

And from April there will also be a charge for passing inspection checks at the UK border – although the government has not yet made the precise costs clear.

The Fresh Produce Consortium (FPC) said some EU companies should prepare for extra costs of up to £2,000 per truck if they put different types of food in the same truck.

The FPC is also furious that the government has this week decided to impose new costs on the import of fruit and vegetables by classifying them as “medium risk”, along with meat and dairy products.

From October, regular physical checks also apply to apples, strawberries, peaches, plums, pears, blueberries and grapes, but also to vegetables such as tomatoes, sweet potatoes and carrots.

Nigel Jenney, chief executive of the FPC, said it was a “major blow to the sector”, adding: “We are talking about significant additional costs. And those higher costs will ultimately be passed on to consumers.”

He also warned that smaller European food companies would give up on Britain. “It could very well be that some decide not to do that [export to Britain]. If I were a European exporter, I would have to think: ‘Is it really worth this huge hassle?’”

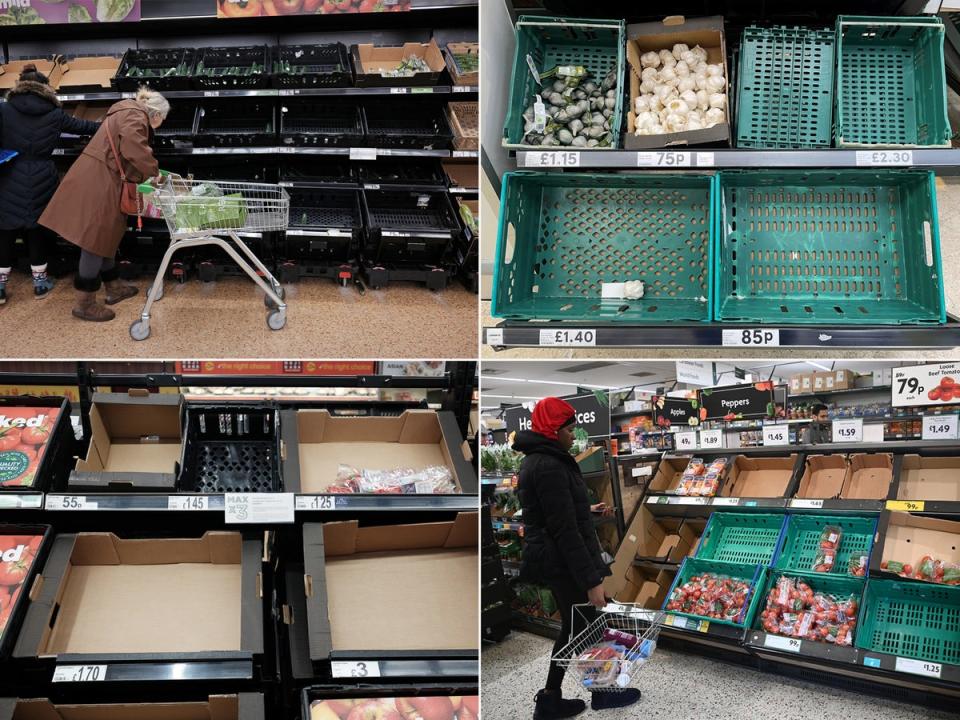

Mr Jenny added: “You saw less choice on the shelves in terms of meats and specialty cheeses. But it impacts everyone in the food industry in terms of costs.”

The warnings come after severe shortages of tomatoes, peppers and other salad vegetables forced British supermarkets to impose rationing last year – with pictures of empty shelves mocked by people living in Europe.

Andrea Rasca, founder of London food markets Mercato Metropolitano, said he worries the new controls will hit the supply of specialist products the hardest. He warned that problems for producers of fresh fruit and vegetables could “negatively impact food prices and the variety of food available”.

He added: “The food and hospitality sector is currently struggling due to Brexit and the cost of living crisis, and the Government should do more to support them.”

The big wave of post-Brexit border controls on imports should start in 2023. But Sunak’s government delayed the introduction until 2024 amid fears the burden could drive up food inflation during the cost of living crisis.

Mr Sunak has rejected calls from food sector leaders to strike a new deal with the EU to cut red tape. Sir Keir Starmer has promised that a Labor government will seek a new veterinary deal with Brussels to align some safety standards, in a bid to reduce trade friction.

British flower importers and growers who rely on young plants from the EU – such as soft fruit such as strawberries and raspberries – appear to be hit by disruption. The National Farmers’ Union has warned this could hamper next year’s harvests and even put some businesses at risk of collapse.

Earlier this month, the Dutch Association of Floricultural Wholesalers said checks should be postponed again until 2025 – warning of problems getting flowers to Britain for Valentine’s Day and Easter.

A government spokesperson has said that after Brexit they remain committed to “delivering the most advanced border in the world”.

They said: “The controls the new model introduces will play a crucial role in keeping Britain safe and protecting our food supply chains and farming sector from harmful disease outbreaks.”

They added: “We are taking a phased approach – including temporarily moving all medium-risk goods from the EU, such as fruit and vegetables, to low-risk to ensure businesses are not faced with unnecessary burdens. We will continue to work closely with businesses across the UK as controls are implemented.”