Five years ago, Telegraph Travel reported on the “remarkable renaissance” of London Southend. Two million passengers left Essex Airport on 9,467 flights in 2019, a year-on-year increase of around 30 per cent.

“Southend is the country’s fastest growing airport – and this week the red carpet rolled out for its newest airline: budget behemoth Ryanair,” we wrote. Routes at the time included Prague, Barcelona, Bergamo, Bilbao and Alicante. It seemed the only way was up.

However, things have gone terribly wrong since then. Ryanair left in 2021, as pandemic rules around air travel took their toll, and four of the five routes mentioned above no longer exist. Only 475 departures were recorded in 2023 – a 95 percent drop on 2019. As I write this, London Southend’s daily departures board shows just two flights: EasyJet flight 7858 to Amsterdam and EasyJet flight 7989 to Alicante (45 minutes delayed). Southend has gone from being Britain’s fastest growing airport.

But a glimmer of hope has emerged. The airport’s owner Esken (formerly the Stobart Group) has reportedly struck a deal to transfer control to Carlyle, the US private equity firm to which it is £193.75 million in debt. The deal includes £32 million in new financing to secure the future of the airport. And as the news broke, EasyJet announced extra summer services from Southend to Palma de Mallorca, Paris and Faro, the gateway to the Algarve. Perhaps the glory days are returning for London’s smallest airport.

A checkered history

Older readers may remember that in the 1960s Southend was actually Britain’s third busiest junction, behind only Heathrow and Manchester.

During its heyday it handled almost 700,000 passengers a year with services to Paris, Ostend, Rotterdam and the Channel Islands, among others. British United Air Ferries, which specialized in cross-Channel flights carrying cars and their owners, became synonymous with Southend. But competition from standard cross-Channel ferries and the growth of Stansted and Luton airports heralded a rapid decline.

The seeds of its revival were sown in 2008 when it was bought for £21 million by the Stobart Group, who then spent more than £100 million regenerating it. EasyJet started services from Southend in 2012; Flybe joined shortly afterwards. The arrival of Ryanair in 2019 certainly seemed to cement its place as a modestly successful but unheralded alternative for those living in London and Essex.

It also won praise at the time from passengers tired of the experience in the capital’s busier hubs. The readers of consumer magazine Which? rated Southend London’s best airport for four years in a row, and in the 2018 poll – which examined eight categories including baggage claim, seating, toilets, security queuing and passport control – it achieved an overall score of 84 percent, putting it behind only Doncaster-Sheffield among all UK airports. Bigger is not necessarily better.

Then came Covid. The pandemic made many people reluctant to travel, two years of ever-changing rules hampered those who did want to leave, and government financial support was often seen as insufficient. Then, just as holidays returned to normal, rising energy costs began forcing both businesses and millions of Britons to tighten their belts.

Britain’s airports are on the brink

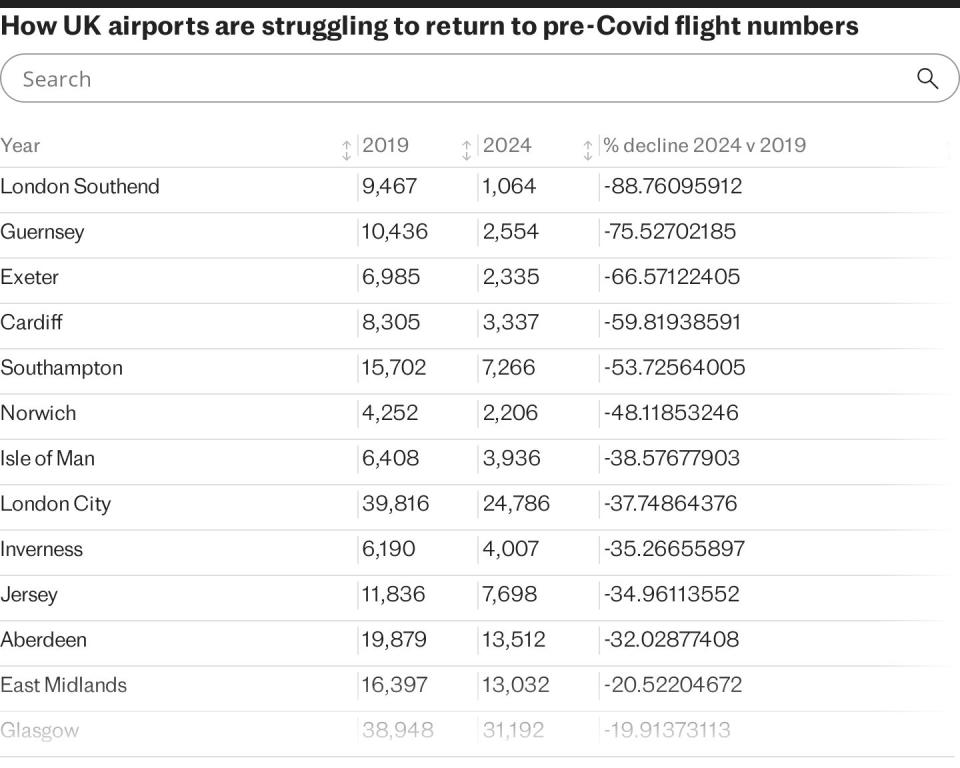

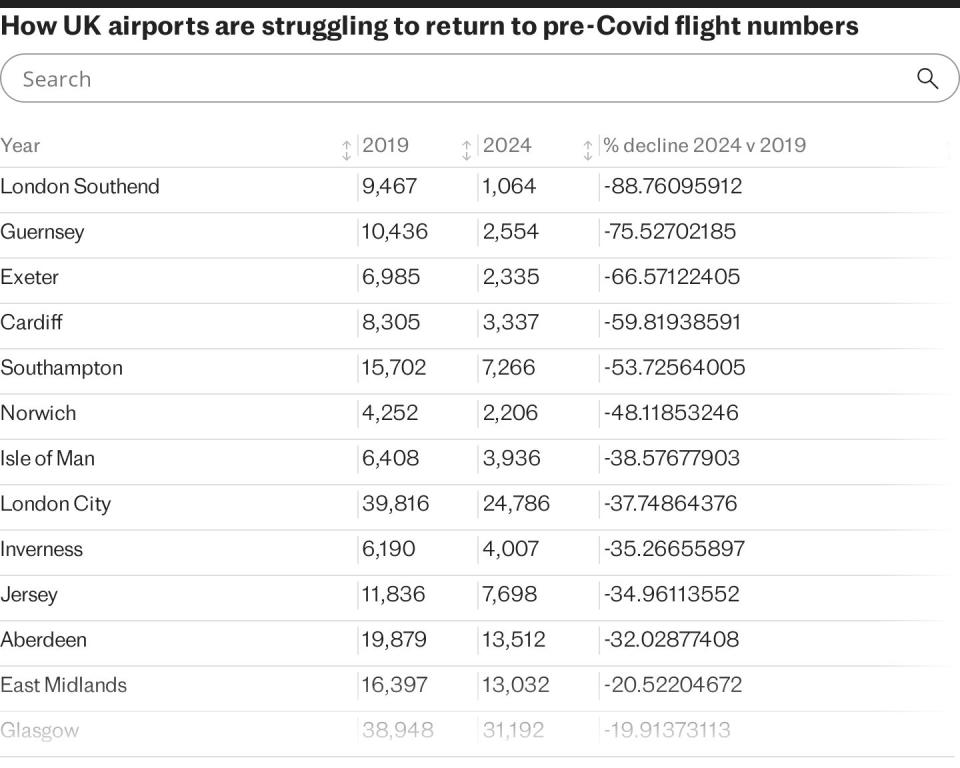

Southend is far from the only British airport battling to get back to its best. Data from aviation analyst OAG shows that only three of the UK’s airports have reached their pre-Covid heights. The 1,064 scheduled departures from Southend in 2024 – although several more flights may be added – represents a decrease of almost 89 percent.

Southampton is another airport facing an uncertain future. It welcomed a record 2.1 million passengers on 19,988 departures in 2017. Only 7,266 departures are scheduled this year (a decline of 53.7 percent). The country was hit hard by the bankruptcy of Flybe in March 2020 and by the collapse of the relaunched Flybe, which planned to return to Southampton, in January 2023. It is hoped for an extension of the runway, which was completed last September, allowing larger aircraft to visit will help it remain profitable.

Then there’s Exeter, another former Flybe hub. There were 6,985 departures in 2019, but only 2,335 are planned for 2024 (a decrease of 66.6 percent). It took £5 million of taxpayers’ money to stay afloat during the pandemic, and money continues to be lost.

Everyone will be desperate to avoid the fate of Doncaster-Sheffield, which closed completely in 2022 despite having its busiest year on record in 2019, when it welcomed 1.4 million passengers on 4,615 departures, to destinations as diverse as Gdansk, Vilnius, Malaga and Amsterdam and Tenerife, and despite its popularity with flyers (according to the Which? surveys).

Will London Southend bring back the glory days?

So what is London Southend’s ceiling? Can it reach two million passengers per year again? The airport is certainly optimistic about the future. A spokesperson said: “In terms of our near-term growth plans, we aim to beat the previous record of two million passengers (as of 2019) in the next two to three years. By 2030, we expect to serve more than five million passengers per year.”

CEO John Upton added in a statement: “With a rapidly growing population of almost eight million within an hour [of the airport], and with other London airports facing a capacity cliff, we are ideally placed to serve airlines looking to expand their operations in the London market. We are also already seeing our passenger volumes double year-on-year, with EasyJet once again announcing more route capacity.”

However, one aviation expert expressed doubts whether reality will match these lofty ambitions. John Grant from OAG said: “[The deal with Carlyle] finally provides clarity on ownership and subsequent direction, and London could certainly use the extra capacity. But can they ever reach the passenger numbers seen previously? Probably not – these volumes were achieved at giveaway rates and losses. Realistically, it might be 800,000 passengers a year.”